Bộ Đề Thi Mẫu Đọc Hiểu Tiếng Anh B1 B2 VSTEP - ĐỌC HIỂU PART 4 - Đề số 3

Bộ Đề Thi Mẫu Đọc Hiểu Tiếng Anh B1 B2 VSTEP - ĐỌC HIỂU PART 4 - Đề số 3

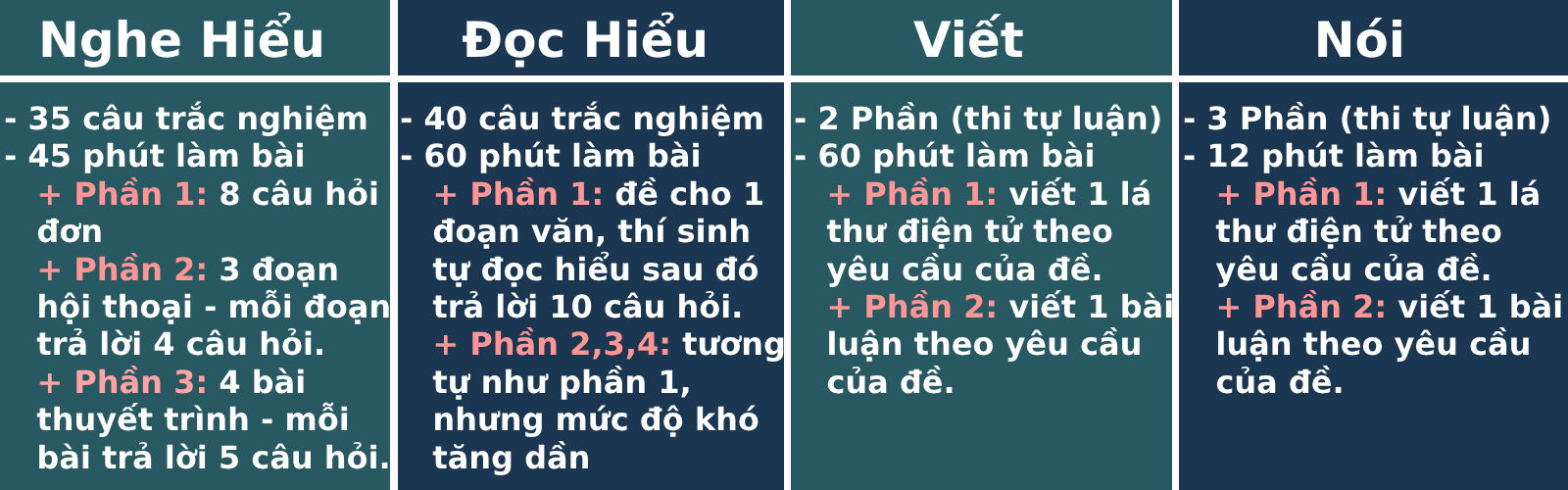

1. Cấu trúc đề thi tổng quát

2. Đề Viết B1 B2 VSTEP: ĐỌC HIỂU PART 4 - Đề số 3

Question 31-40

You should spend about 15 minutes on this task.

In many countries, access to capital markets and low-interest loans is limited to large corporations and government monopolies. Small businesses and suppliers do not have access to liquid cash, and run the risk of failing to fulfil orders because they do not have the capital to purchase supplies for the products they make. As a result of this credit crisis, a practice called factoring has become popular in many areas of the world.

In factoring, a bank or financial organization called a factor gives a supplier cash in exchange for the right to collect payment when the supplier delivers an order to a buyer. In effect, the factor is buying the supplier's Accounts Receivables at a discount off the face value of the accounts. The supplier benefits by receiving cash more quickly than it could from the buyer, but does not receive full payment for the accounts. The factor takes on a huge amount of risk by buying a supplier's Accounts Receivables, as each individual buyer must be researched to determine what the risk is of that buyer defaulting on payment. In some cases, these buyers are so small or obscure that risk cannot be determined, and a factor is buying a complete unknown. In this case, if a buyer defaults, the factor may go back to the supplier and ask for compensation for the default. Thus, factoring is risky for both the supplier and the factor.

In recent years, a new practice called reverse factoring has become increasingly popular because it shifts the anchor from supplier to buyer to virtually eliminate risk from the transaction, In reverse factoring, instead of buying a supplier's Accounts Receivables, a factor provides loans to a single large buyer's suppliers.

For example, a large corporation with an excellent credit rating and an extremely low chance of defaulting will have a list of suppliers. Many of these suppliers are small businesses without adequate access to liquid cash. When a factor contracts with the large buyer to supply payments to suppliers, the transaction works as follows: 1) the supplier signs an agreement to be entered into the factor's system, 2) the supplier delivers an order to the buyer, 3) the buyer approves the delivery and signs off with the factor, 4) the factor pays the supplier a percentage (usually 80 to 90 percent) of the price of the order immediately, 5) the buyer pays the factor for the order at whatever terms the agreement states, 6) the factor pays the supplier the remaining balance for the order. The factor takes a percentage of the transaction and charges interest to the buyer.

By originating the transaction with a large, risk-free buyer instead of a supplier, reverse factoring improves all three parties' positions and liquidity. The factor earns a steady interest rate with very little risk, and by working with large buyers, has access to large volumes of business at one time. The buyers gain the ability to pay on better terms for lower interest than they would with traditional capital market structures. Suppliers get paid far more rapidly and at a far lower interest rate than they would be able to with a traditional factoring or capital market arrangement.

31. Why has factoring increased as a practice in countries around the world?

A. it has a common language

B. it attracts investors to foreign countries

C. it solves a problem with credit

D. it requires large amounts of land

32. The word 'capital' in paragraph 1 is closest in meaning to

A. financial

B. principal

C. important

D. knowledgeable

33. The word 'defaults' in paragraph 2 is closest in meaning to

A. does not ask

B. does not know

C. does not pay

D. does not loan

34. What is the benefit of reverse factoring?

A. it removes risk almost entirely from the transaction

B. it does not involve an exchange of money

C. it can be done on a boat or other sailing vessel

D. it can be done by anyone, regardless of income 3

5. How is reverse factoring different from traditional factoring?

A. Both suppliers and factors might be at risk.

B. Factors buy suppliers' Accounts Receivables

C. Suppliers receive cash directly from buyers.

D. Suppliers can receive money from the factors contracted with buyers

36. The word 'liquid' in paragraph 4 is closest in meaning to

A. accessible

B. wet

C. complex

D. thin

37. In reverse factoring, after the factor pays the supplier a percentage of the order amount

A. the supplier officially enters the factor's system

B. the buyer pays the factor for the order

C. the supplier delivers the order to the buyer

D. the factor contracts with the buyer

38. The phrase 'all three parties' in paragraph 5 refers to

A. bank, factor, buyer

B. factor, bank, supplier

C. supplier, bank, product

D. factor, buyer, supplier

39. Why does the author mention the benefits of reverse factoring to the factor in paragraph 6?

A. prove that there is not a strong connection between a role in the reverse factoring transaction and the benefits received

B. show that the factor benefits more from reverse factoring than the supplier or the buyer

C. support the topic sentence of the paragraph that states that all three parties benefit from reverse factoring

D. connect the concept of factoring more closely with reverse factoring

40. Which of the following can be inferred from the passage?

A. There are multiple ways to finance purchases from suppliers.

B. A factor must be prequalified to borrow money from a supplier

C. Reverse factoring only works in European countries

D. Small suppliers are more likely to have access to credit than small buyers.

3. Đáp án

31. C

32. A

33. C

34. A

35. B

36. A

37. B

38. D

39. C

40. A